It’s no surprise that college students spend the most money on food by eating out at restaurants and getting food delivered during those late-night study sessions. Now, whether that’s a dangerous waste of money or not depends on their budget.

You don’t know if your college student has a budget? It’s time to find out and then help them out! Confident budgeting can make their college experience low on financial stress. (The academic stress is enough, right?)

What is a Budget?

Maybe it’s a silly question, but it’s important to start at the beginning. A budget is an estimate of income and expenses. Like any successful business, each individual person needs to know their income/expenses in order to know how much they can spend on their needs and wants. Encourage your student to think of themself as a business and run their finances accordingly.

What Should a College Student’s Budget Include?

Depending on how their biggest expenses like tuition, books, and rent/housing/utilities are being covered, every college student’s budget will vary. For our teaching purposes, let’s skip the expenses of attending college and review the expenses of living that go along side it. A college student will need to plan to spend money on:

-

Vehicle and related or transportation expenses

-

School supplies (besides textbooks)

-

Food expenses

-

Clothing expenses

-

Fun/entertainment expenses

Start the Old-Fashioned Way

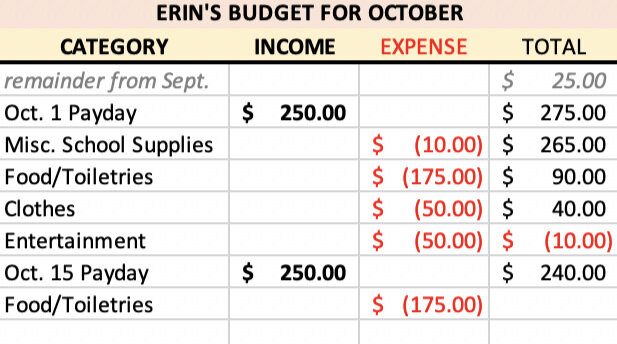

There are an endless number of apps available online for budget tracking, but there’s just something about writing things down with a pen and paper that makes it more real. If at all possible, encourage your student to maintain a simple spreadsheet of their budget—at least for a couple of months. It should look something like this:

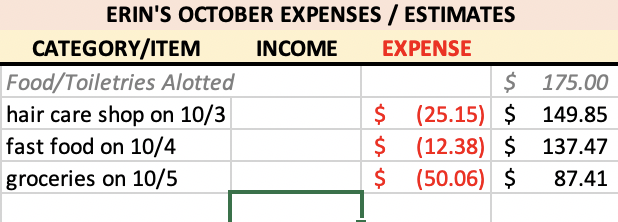

Income and expenditures should be estimated for the future so a full month’s budget can be seen at a glance. Then expenses for individual categories can be broken out into their own spreadsheets so your student can really see where their money is going.

The benefit of being this detailed is knowing where you are over-spending so you can adjust the estimates or rein in the spending.

Budgeting is Not a Punishment

Remind your student that it’s normal to want to spend our own money as we see fit, with no parameters or limits, but for most of us, that’s not reality. Budgeting allows them to make the choices they want. If they want to eat out more, then they can include that in their budget by reducing planned expenses for clothing or grocery store food costs. Ultimately, budgeting will reduce their stress about running out of money when there’s still a non-negotiable ahead. And hopefully cut down on the requests to mom or dad for additional funds!